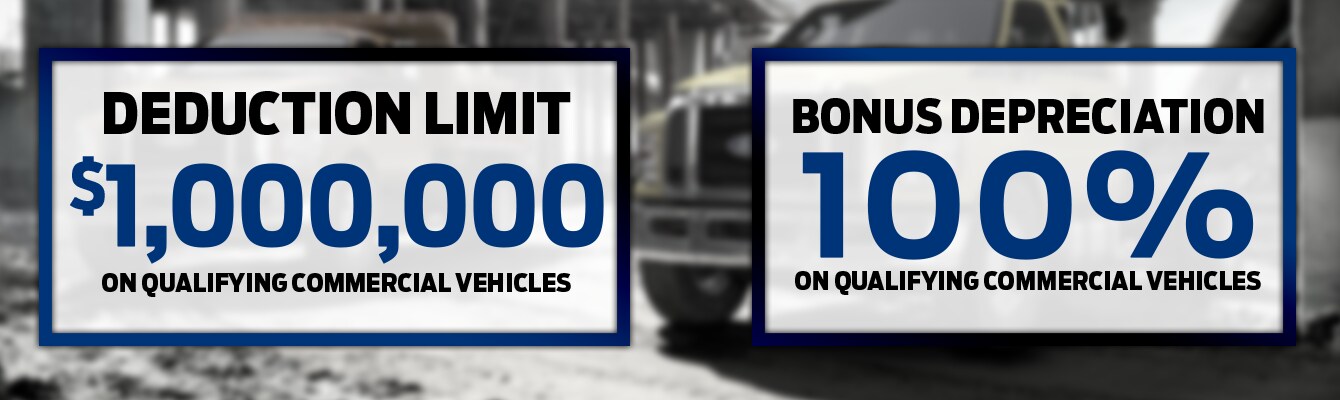

Have you familiarized yourself with the Section 179 tax deduction? This beneficial IRS program was formed to assist small businesses to reach their goals. The sales team at your local Ford dealer in NJ wants to bring to light the many reasons to utilize the Section 179 program. This tax code will let businesses deduct from the gross income the final purchase price of qualifying software and equipment - up to $1,000,000* - that your company acquired during the business calendar year. Qualified purchases of software and equipment are eligible for a deduction equal to the full purchase price, allowing you to earn money back when filing your taxes at the end of the year!

The Section 179 tax deduction was activated by the U.S. government in 2010 to trigger growth in small businesses. In order to take full advantage of the deductions, you must purchase and use the equipment by the 12/31/2019 expiration date. For vans, trucks, and other commercial vehicles that are used for greater than 50 percent for business purposes, the cumulative depreciation deduction will include both the Section 179 tax deduction and 100 percent Bonus Depreciation. The Bonus Depreciation now incorporates used equipment and is generally applied once larger businesses meet or exceed the Section 179 spending cap.

The sales professionals at Echelon Ford are at the ready to show off the vast inventory of Ford commercial vehicles, and encourage you to invoke all clauses covered by the Section 179 deduction that is of benefit. Your local Ford dealership in NJ welcomes you to our showroom to scope out the lineup of new Ford commercial models, including the Ford F-250 Super Duty, the Ford Transit van model, and perhaps a shiny new Ford Explorer for the growing fleet. Head on over to Echelon Ford today for further information on commercial vehicles and don't forget to inquire about the Section 179 tax deduction!

Hours

- Monday 9am-8pm

- Tuesday 9am-8pm

- Wednesday 9am-8pm

- Thursday 9am-8pm

- Friday 9am-8pm

- Saturday 9am-5pm

- Sunday Closed

Make an Inquiry

* Indicates a required field